Just How Mortgage Brokers Simplify the Process of Obtaining Mortgage Loans

Wiki Article

Specialist Home Mortgage Brokers Helping You Protect the most effective Prices

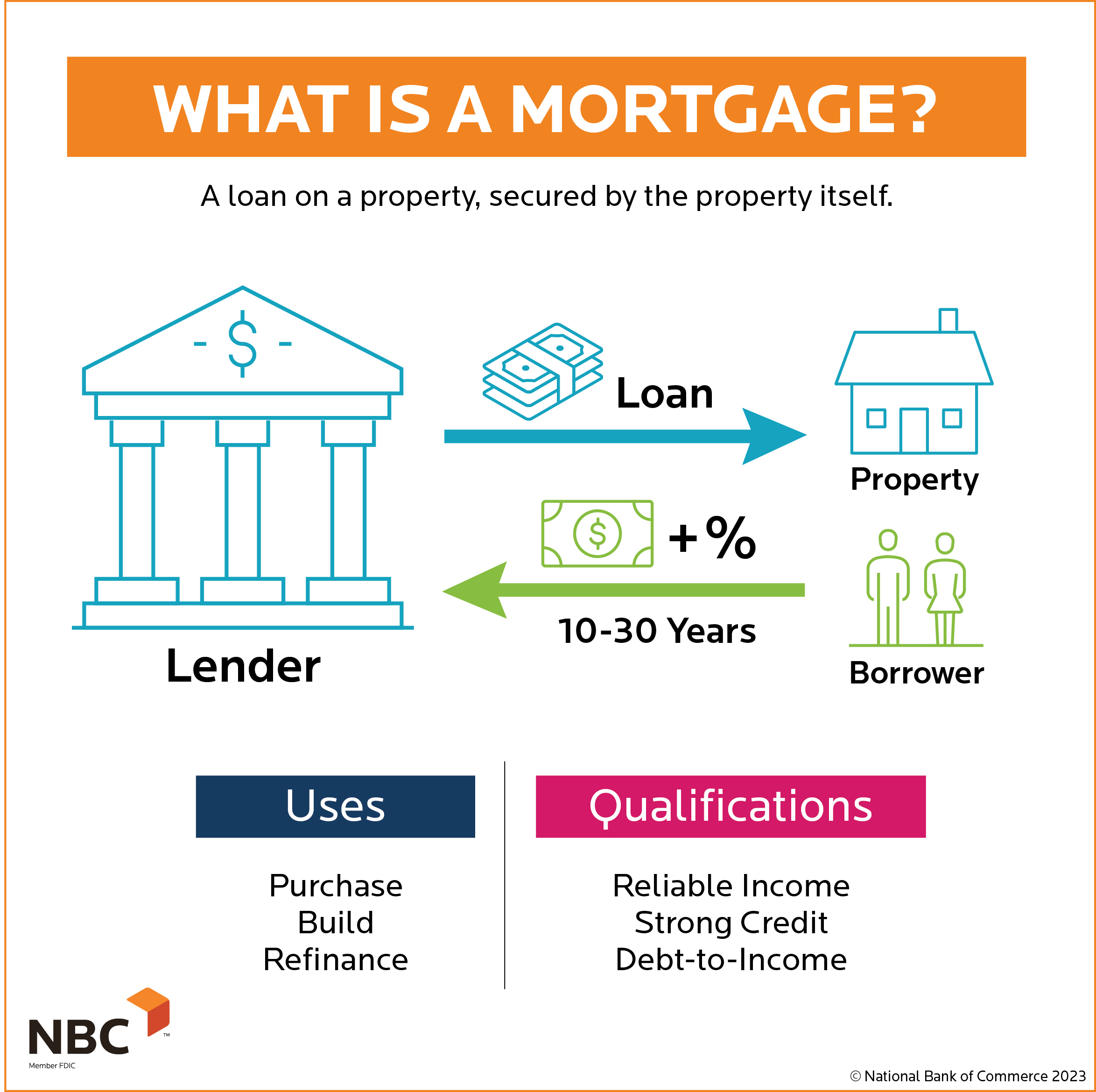

Browsing the mortgage landscape can be a difficult job, yet skilled home loan brokers are outfitted to streamline this procedure and safeguard the most positive prices for their customers. As you consider your options, it's vital to discover what absolutely sets expert brokers apart in this competitive atmosphere.Advantages of Utilizing Home Loan Brokers

Why should homebuyers think about making use of home mortgage brokers in their search for the very best prices? Mortgage brokers act as valuable intermediaries between customers and lenders, offering numerous benefits that can dramatically boost the homebuying experience. Mortgage Broker. One of the key benefits is their accessibility to a broad array of home loan items. Unlike traditional lenders, that might just offer their own financing choices, brokers can present various finance items from numerous economic institutions, enabling homebuyers to compare terms and rates extra properly.Furthermore, home loan brokers possess in-depth market understanding and knowledge, which can be especially beneficial for novice property buyers. They can provide personalized advice customized to individual economic scenarios, aiding customers browse complex mortgage procedures. Brokers commonly have established connections with lending institutions, which might result in much better rates and terms than those readily available directly to debtors.

An additional substantial benefit is the moment conserved during the home loan procedure. Brokers manage much of the paperwork and interaction with lenders, enabling homebuyers to concentrate on various other elements of their building search. Generally, using a home loan broker can result in much more favorable home loan terms, a structured procedure, and notified decision-making for prospective property buyers.

How Home Mortgage Brokers Work

Home mortgage brokers run as middlemans in between lenders and consumers, facilitating the home loan application process. Brokers analyze the economic circumstance of customers, including earnings, debt history, and general financial goals.Once a borrower picks a favored choice, brokers help in collecting essential documentation and sending the home mortgage application to the lender. They preserve interaction in between all events entailed, making certain that updates are passed on quickly which any type of questions or concerns are dealt with efficiently. Throughout the procedure, brokers take advantage of their expertise to negotiate positive terms, making every effort to secure the very best prices for their clients.

In addition, mortgage brokers remain informed about market patterns and governing modifications, which permits them to provide important insights and guidance - Mortgage Lenders Omaha. By utilizing their extensive network, brokers streamline the mortgage process and enhance the likelihood of lending approval, ultimately conserving borrowers effort and time in accomplishing their homeownership objectives

Key Qualities of Expert Brokers

Successful mortgage brokers have several key high qualities that distinguish them in an affordable sector. They show extraordinary communication skills. This capacity enables them to effectively communicate complex monetary details to clients, ensuring that debtors comprehend their alternatives and the implications of their selections.Furthermore, expert brokers show solid analytical abilities. They expertly analyze customers' economic scenarios and market problems, enabling them to recognize one of the most suitable home loan products tailored to individual demands. A detailed understanding of the home loan landscape, consisting of rates of interest, lending institution demands, and funding choices, further boosts their efficiency.

Additionally, successful brokers present a high level of stability and reliability. Building long-term partnerships with clients relies on openness and ethical techniques, promoting self-confidence throughout the home loan procedure.

In addition, a proactive strategy is important. Expert brokers actively look for the very best offers, often connecting with lending institutions to remain updated on new offerings and changes on the market.

Usual Blunders to Avoid

Browsing the mortgage process can be complicated, and many consumers drop right into common catches that can prevent their financial objectives. One prevalent blunder is failing to shop around for the ideal rates. Counting on a single lending institution can cause missed out on opportunities for better offers. It's necessary to compare offers from multiple brokers to make sure competitive prices.Another challenge is not understanding the complete expense of the mortgage, including costs and closing expenses. Lots of borrowers focus solely on the rates of interest, overlooking these additional costs that can considerably influence the overall loan quantity.

Furthermore, Continue disregarding to inspect credit rating prior to applying can cause shocks. A bad credit history can impact the prices readily available, so it's smart to examine your credit score report and attend to any type of problems in advance.

Lastly, hurrying the decision-making process can bring about regret. Take the time to research study various home mortgage types and terms, guaranteeing you choose one that straightens with your economic circumstance. By avoiding these typical errors, customers can position themselves for a smoother, extra effective home mortgage experience.

Steps to Select the Right Broker

Following, seek suggestions from close friends, family members, or property specialists. Individual references supply beneficial understandings right into a broker's track record and performance. In addition, research study online evaluations and endorsements to gauge client contentment.

When you have a shortlist, conduct meetings with potential brokers. Ask about their communication style, schedule, and the series of home loan products they offer. An experienced broker needs to have the ability to clarify complex terms in such a way that is easy to understand.

Furthermore, make inquiries regarding their cost structure. Understanding just how brokers are made up-- whether with commissions or level costs-- will certainly aid you examine their transparency and possible disputes of passion.

Verdict

In final thought, experienced home mortgage brokers considerably improve the chance of protecting favorable mortgage rates and terms. By understanding the nuances of the monetary landscape and supplying tailored recommendations, these brokers serve as indispensable allies for Bonuses consumers.Navigating the mortgage landscape can be a difficult job, yet professional home loan brokers are equipped to simplify this procedure and secure the most beneficial rates for their clients.Why should homebuyers think about utilizing mortgage brokers in their search for the best rates? Overall, using a home loan broker can lead to more favorable mortgage terms, a structured procedure, and informed decision-making for possible property buyers.

Mortgage brokers operate as middlemans in between consumers and loan providers, facilitating the mortgage application procedure.In verdict, skilled home loan brokers considerably enhance the likelihood of safeguarding favorable home loan rates and terms.

Report this wiki page